What influences ROI for high-end properties? Essential insights for investors

When it comes to luxury rental properties, understanding the potential ROI (Return on Investment) is crucial for maximising returns. Several key factors influence the ROI, each contributing to the overall profitability of an investment. Here’s an in-depth look at what affects ROI and how luxury rentals can offer substantial returns.

1. Location

Location is the most significant factor in determining rental ROI. Properties situated in prime or high-demand areas typically offer higher rental yields. For luxury rentals, being in a sought-after location can mean commanding premium rents and achieving a higher ROI. In Marbella, for instance, the demand for properties often exceeds supply, which can drive up rental values and returns.

2. Sustainability

Sustainable features are becoming increasingly important in real estate investment. Properties with energy-efficient upgrades, such as solar panels or high-quality insulation, tend to have lower ongoing costs. This reduction in operating expenses can significantly boost net rental yield. Sustainable properties appeal to eco-conscious tenants and provide financial benefits through decreased utility bills and potential tax incentives.

3. Quality

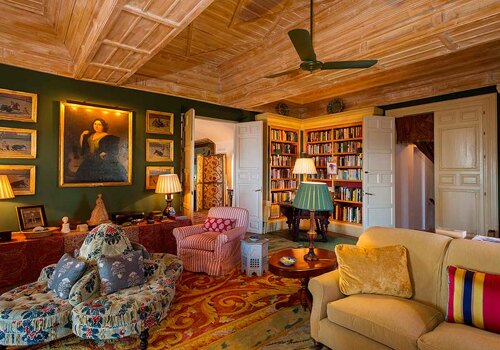

The quality of the property plays a critical role in attracting high rents and minimizing vacancies. Well-maintained, high-quality properties—those with modern amenities, superior construction, and appealing finishes—are more likely to attract discerning tenants willing to pay premium rents. Such properties often experience fewer maintenance issues and can retain their value better over time, further enhancing ROI.

4. Market trends

Economic factors and rental market trends are also essential considerations. The broader economic environment, including interest rates, employment levels, and local market conditions, can impact rental income and property values. Staying informed about market trends helps investors make strategic decisions and adapt to changing conditions, which can optimize rental income and overall ROI.

5. Demand and supply dynamics

In high-demand markets like Marbella, where the demand for luxury properties often outpaces supply, rental yields can be particularly attractive. The limited availability of high-quality rental properties in such areas can drive up prices, offering the potential for impressive returns. By investing in locations with strong demand and limited supply, investors can maximize their rental income and achieve higher ROI.

In summary, achieving a high ROI for luxury rentals involves carefully considering these factors. By focusing on prime locations, incorporating sustainable features, ensuring high property quality, and staying attuned to market trends, investors can enhance their rental returns. In high-demand areas like Marbella, luxury properties often have the potential to reach or exceed a 10% ROI annually, making them a lucrative investment choice.